Understanding Copulas

In statistics, copulas are functions that allow us to define a multivariate distribution by specifying their univariate marginals and interdependencies separately. In modelling returns of assets, for example, this enables greater flexibility and ability to model joint behaviour in extreme events.

Let’s study this in further detail using daily log returns of two assets, Apple and Goldman Sachs, over a 12-year period.

library(tseries)

options("getSymbols.warning4.0"=FALSE)

a <- get.hist.quote(instrument = 'AAPL',

start="2009-01-04", end="2021-01-04",

quote = c("AdjClose"), provider = "yahoo",

compress = "d")

b <- get.hist.quote(instrument = 'GS',

start="2009-01-04", end="2021-01-04",

quote = c("AdjClose"), provider = "yahoo",

compress = "d")

df <- data.frame(list(diff(log(a)), diff(log(b))))

colnames(df) <- c('aapl', 'gs')

time series starts 2009-01-05

time series ends 2020-12-31

time series starts 2009-01-05

time series ends 2020-12-31

Let’s take a peek at the top 10 rows of the dataframe.

print(head(df[1:10,], 10))

aapl gs

2009-01-06 -0.01663156 -0.0007888361

2009-01-07 -0.02184523 -0.0486211860

2009-01-08 0.01839934 0.0107118530

2009-01-09 -0.02313506 -0.0175993365

2009-01-12 -0.02142469 -0.0773947112

2009-01-13 -0.01077318 0.0032132961

2009-01-14 -0.02750955 -0.0290366487

2009-01-15 -0.02311758 -0.0248805384

2009-01-16 -0.01267316 -0.0106212447

2009-01-20 -0.05146606 -0.2102222980

Modeling Tail Dependence

Say we want to estimate tail dependence of these assets, i.e. co-movements at the extreme ends of daily returns. In other words, what is the chance that AAPL’s worst cases are also GS’s worst cases?

Let

We first compare the tail depedencies, at various probabilities, of the empirical data and 100000 samples from a bivariate normal distribution (with its mean and covariance matrix estimated from the data).

# parameter estimates

cat('Sample mean:\n')

cat(df_means <- c(mean(df[,1]), mean(df[,2])))

cat('\n\n')

cat('Sample covariance:\n')

print((df_cov <- cov(df)))

library(mvtnorm)

set.seed(42)

# 100k samples from bivariate normal

mvn_samples <- rmvnorm(1e5, df_means, df_cov)

Sample mean:

0.001264829 0.0004185186

Sample covariance:

aapl gs

aapl 0.0003283744 0.0001778626

gs 0.0001778626 0.0004364080

probs <- c(0.2, 0.1, 0.05, 0.02, 0.01, 0.005, 0.001)

tally1 <- matrix(0, 2, 7)

for (i in 1:7){

q = probs[i]

tally1[,i] = c(

(sum((df[,1]<quantile(df[,1], q))*(df[,2]<quantile(df[,2], q))) /

sum((df[,1]<quantile(df[,1], q)))),

(sum((mvn_samples[,1]<quantile(mvn_samples[,1], q)) *

(mvn_samples[,2]<quantile(mvn_samples[,2], q)))

/ sum((mvn_samples[,1]<quantile(mvn_samples[,1], q))))

)

}

tally1_df <- as.data.frame(tally1, row.names=c('observed','normal'))

colnames(tally1_df) <- as.character(probs)

print(tally1_df)

0.2 0.1 0.05 0.02 0.01 0.005 0.001

observed 0.4668874 0.4337748 0.397351 0.3114754 0.3225806 0.1875 0.50

normal 0.4176500 0.3066000 0.218000 0.1570000 0.1130000 0.0800 0.07

We observe as the probabilities get smaller, the calculated tail dependences between empirical returns and data sampled from the bivariate normal distribution begins to differ greatly.

Let’s try to do better with copulas.

Introducing Copulas

The term ‘copula’ is derived from the Latin for ‘link’, and in our context, is named aptly so. We can understand copulas as multivariate cumulative distribution functions that link marginal distributions and describe their interdependencies. Its marginal distributions are all Uniform(0,1), we use Uniform as a ‘bridge’ since a random variable from any distribution can be transformed to Uniform and back with the probability integral transform.

The copula of a random vector

Some common examples include

- independence copula:

- co-monotonicity copula:

- Gaussian copula:

We will be using the copula package, which has various common predefined copulas for us to choose and sample from.

Estimating Marginal Distributions

Before that, let us first fit marginal distributions for the daily returns of AAPL and GS with the help of the MASS package. fitdistr() will help us find the optimal parameters given a distribution, so let us compare between the AIC for Normal, t and Cauchy distributions.

options(warn=-1)

library(MASS)

cat('AAPL\n')

cat(paste('Normal:\t',AIC(fitdistr(df$aapl, 'normal')),'\n'))

cat(paste('t:\t',AIC(fitdistr(df$aapl, 't')), '\n'))

cat(paste('Cauchy:\t',AIC(fitdistr(df$aapl, 'cauchy')), '\n'))

cat('\nGS\n')

cat(paste('Normal:\t',AIC(fitdistr(df$gs, 'normal')),'\n'))

cat(paste('t:\t',AIC(fitdistr(df$gs, 't')), '\n'))

cat(paste('Cauchy:\t',AIC(fitdistr(df$gs, 'cauchy')), '\n'))

AAPL

Normal: -15645.9234978236

t: -16179.9680136581

Cauchy: -15654.6146727265

GS

Normal: -14787.2501190948

t: -15752.4739791247

Cauchy: -15282.9761802124

t distribution gives the lowest AIC, so we shall use that as our marginals. Let’s proceed to extract the optimal parameters for both assets. Note that fitdistr() uses the location-scale family, so besides the degree of freedom, location m and scale s are returned as well.

cat('AAPL\n')

(aapl_t_param <- fitdistr(df$aapl, 't'))

aapl_m <- aapl_t_param$estimate['m']

aapl_s <- aapl_t_param$estimate['s']

aapl_df <- aapl_t_param$estimate['df']

cat('\nGS\n')

(gs_t_param <- fitdistr(df$gs, 't'))

gs_m <- gs_t_param$estimate['m']

gs_s <- gs_t_param$estimate['s']

gs_df <- gs_t_param$estimate['df']

AAPL

m s df

0.0014079306 0.0122031312 3.4246717881

(0.0002668132) (0.0002885762) (0.2373954742)

GS

m s df

0.0005630129 0.0124256289 2.9726045290

(0.0002772650) (0.0002930408) (0.1810629562)

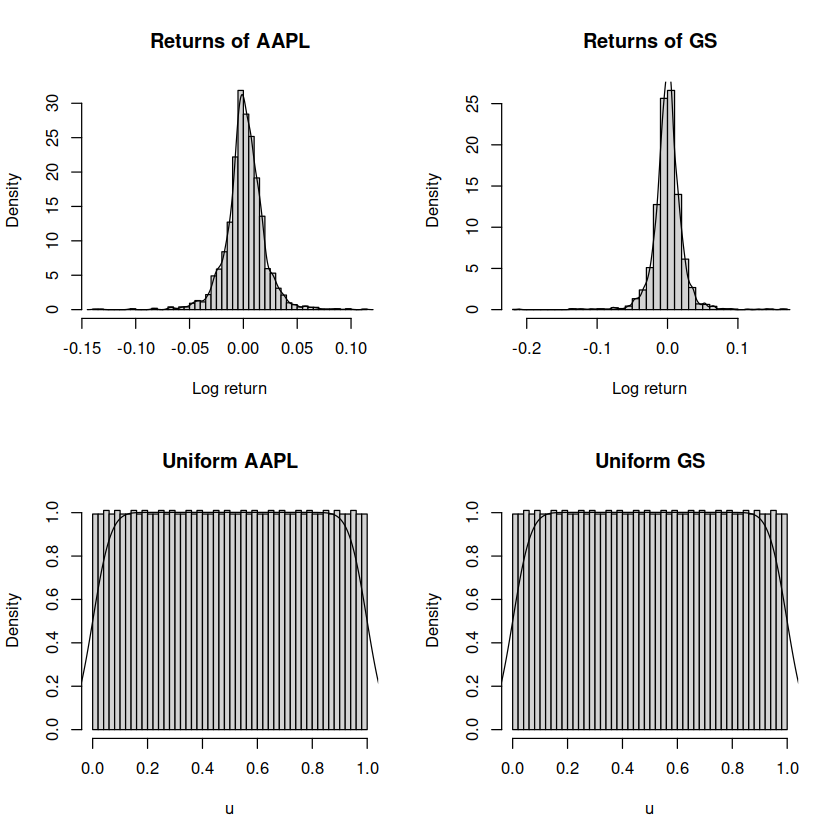

We’ll now transform the data into Uniform(0,1) by taking their order statistics and dividing it by the number of observations plus one. The ‘+1’ is added as a pseudo-observation so that all variates are forced inside the unit space to avoid problems with density evaluations at the boundaries. Without this, fitcopula() will throw an error.

As a side note, let’s briefly see how this works. We want to show that taking the ranks of variates

With

Then

u_aapl <- rank(df$aapl)/(nrow(df)+1)

u_gs <- rank(df$gs)/(nrow(df)+1)

u_df <- data.frame(list(u_aapl, u_gs))

colnames(u_df) <- c('u_aapl', 'u_gs')

# original density of returns

par(mfrow=c(2, 2))

hist(df$aapl, freq=FALSE, breaks=50,

main="Returns of AAPL", xlab="Log return")

lines(density(df$aapl))

hist(df$gs, freq=FALSE, breaks=50,

main="Returns of GS", xlab="Log return")

lines(density(df$gs))

# transformed density of returns (uniform)

hist(u_aapl, freq=FALSE, breaks=50,

main="Uniform AAPL", xlab="u")

lines(density(u_aapl))

hist(u_gs, freq=FALSE, breaks=50,

main="Uniform GS", xlab="u")

lines(density(u_gs))

Choosing and Fitting Copulas

The copula library gives a wide selection of common copulas (elliptical and frequently-used Archimedean copulas). Fitting a few, we observe that the t copula gives us the best fit in terms of maximum pseudo-likelihood.

library(copula)

fitCopula(normalCopula(dim=2), data=u_df)

cat('\n\n')

fitCopula(tCopula(dim=2), data=u_df)

cat('\n\n')

fitCopula(gumbelCopula(dim=2), data=u_df)

Call: fitCopula(copula, data = data)

Fit based on "maximum pseudo-likelihood" and 3019 2-dimensional observations.

Copula: normalCopula

rho.1

0.439

The maximized loglikelihood is 320.9

Convergence problems: code is 52 see ?optim.

Call: fitCopula(copula, data = data)

Fit based on "maximum pseudo-likelihood" and 3019 2-dimensional observations.

Copula: tCopula

rho.1 df

0.4327 4.6111

The maximized loglikelihood is 372

Optimization converged

Call: fitCopula(copula, data = data)

Fit based on "maximum pseudo-likelihood" and 3019 2-dimensional observations.

Copula: gumbelCopula

alpha

1.361

The maximized loglikelihood is 291.7

Optimization converged

A 2-dimensional t-copula has the following form:

where

Let’s fit a t copula with the fitted parameters from above (

Then, again with the probability integeral transform, we transform the these Uniform samples back to their marginal distributions, which we have selected as t distributions as studied earlier. Since the quantile

t_cop_fit_est <- fitCopula(tCopula(dim=2), data=u_df)@estimate

t_cop_fit_rho <- t_cop_fit_est[1]

t_cop_fit_df <- t_cop_fit_est[2]

t_cop <- tCopula(t_cop_fit_rho, df=t_cop_fit_df)

t_cop_samples <- rCopula(1e5, copula=t_cop)

t_cop_aapl <- qt(t_cop_samples[,1], df=aapl_df) * aapl_s + aapl_m

t_cop_gs <- qt(t_cop_samples[,2], df=gs_df) * gs_s + gs_m

Tail Dependence with Copula

With the generated marginal samples, we can now calculate tail depedence using the method we saw earlier.

tally2 <- matrix(0, 3, 7)

for (i in 1:7){

q = probs[i]

tally2[,i] = c(

(sum((df[,1]<quantile(df[,1], q))*(df[,2]<quantile(df[,2], q))) /

sum((df[,1]<quantile(df[,1], q)))),

(sum((mvn_samples[,1]<quantile(mvn_samples[,1], q)) *

(mvn_samples[,2]<quantile(mvn_samples[,2], q)))

/ sum((mvn_samples[,1]<quantile(mvn_samples[,1], q)))),

(sum((t_cop_aapl<quantile(t_cop_aapl, q))*(t_cop_gs<quantile(t_cop_gs, q))) /

sum((t_cop_aapl<quantile(t_cop_aapl, q))))

)

}

tally2_df <- as.data.frame(tally2, row.names=c('observed',

'normal',

't copula'))

colnames(tally2_df) <- as.character(probs)

print(tally2_df)

0.2 0.1 0.05 0.02 0.01 0.005 0.001

observed 0.4668874 0.4337748 0.397351 0.3114754 0.3225806 0.1875 0.50

normal 0.4176500 0.3066000 0.218000 0.1570000 0.1130000 0.0800 0.07

t copula 0.4217500 0.3365000 0.293800 0.2590000 0.2380000 0.2440 0.23

It is also possible to calculate the tail dependence of copulas by

2-2*(pt(sqrt(t_cop_fit_df+1)*sqrt(1-t_cop_fit_rho)/

sqrt(1+t_cop_fit_rho),

df=t_cop_fit_df+1))

0.190010784498546

Although empirically at

Compared to simulated data from the bivariate normal distribution earlier, the simulation from the t copula is closer to the empirical data and produce substantial estimates at the tail, albeit still lower. In extreme cases like

In the event of insufficiency of data, copulas are also able to provide a theoretical measure of tail dependence. It is however noteworthy that not all copulas model tail dependences. t copula provides the above formula for both lower and upper tail dependences, while Gumbel copula, for example, only models upper tail dependence.

Cover image: Karine Avetisyan (Unsplash)

Enjoyed reading this article? More articles you might like to read next: